Politicians don’t seek out Ian Cull to lower his property tax bill.

The 40-year-old Chicago man has never received a call from his mayor asking if he can introduce him to House Speaker Mike Madigan.

And the powerful Speaker has never sat across a dinner table wooing the father of three for an opportunity to fight for a property tax reduction for his 2-bedroom, 127-year-old Wicker Park home.

“You’d have to be a fool not to want to see your taxes lowered in this city,” Cull said. He added that no politician has ever taken a particular interest in his family’s tax bill.

But for many commercial property owners in Cook County, that’s not the case. Law firms owned by elected officials or major campaign contributors routinely approach commercial property owners and try to cut deals.

“Ordinary taxpayers should be quite concerned about politically connected law firms doing this because it costs the rest of us in one of three ways,” said David Cay Johnston, a Pulitzer Prize winning journalist who covered taxation issues for the New York Times. “Services could be cut because of reduced revenue, taxes on the rest of will go up to make up for the lost revenue or government will go deeper into debt.”

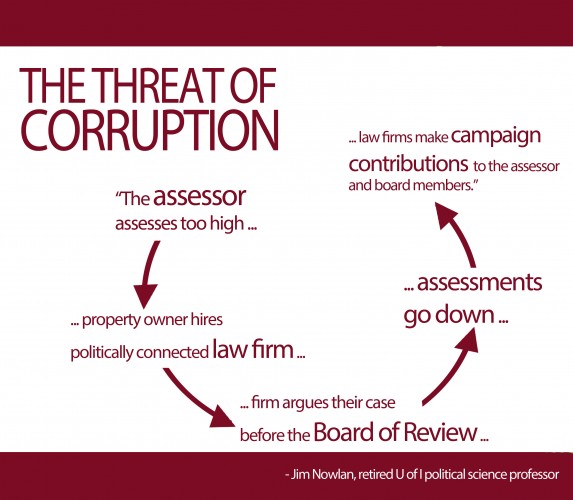

Longtime Illinois political observer Jim Nowlan said it is a vicious cycle that rewards high assessments.

Longtime Illinois political observer Jim Nowlan said it is a vicious cycle that rewards high assessments.

“Basically, the assessor assesses too high, the property owner has no alternative but to go out and hire one of these politically connected law firms. The firms argue their case before the Board of Review and then the assessments go down. And then the law firms make campaign contributions to the assessor and the board of review members. The only people who benefit from this system are the lawyers and the politicos. Ordinary taxpayers really get the short-end of the stick,” said Nowlan, a retired political science professor at the University of Illinois.

In Chicago a small number of law firms specialize in handling Cook County property tax appeals and their lawyers have some of the biggest names in Illinois politics.

Madigan, Senate President John Cullerton and Chicago Alderman Ed Burke, are among the constellation of political stars whose law firms engage in the lucrative practice of appealing the property tax bills of commercial properties in Cook County.

There are a number of avenues toward lowering property taxes in Cook County.

Among the most common are:

- Filing a request with the assessor asking for a reduction in a property’s assessed value.

- Appealing the assessor’s valuation to the Cook County Board of Review.

- Suing and allowing a judge to decide on the value of a property.

- Entering into a lawsuit settlement agreement with the Cook County State’s Attorney.

But since the assessor, board of review commissioners, Cook County judges and the state’s attorney all are elected officials, they may be vulnerable to influence by powerful political interests said Dick Simpson, a political science professor at the University of Illinois at Chicago.

Candidates for these offices often seek to curry favor from politically connected individuals such as Madigan, who heads the state Democratic Party, or Burke, who is one of Chicago’s most influential aldermen.

Cook is one of only six Illinois counties where the Board of Review is elected rather than appointed by the county board, said Wendy Ryerson, past president of the Illinois County Officials Association.

She added that unlike a majority of Illinois’ 102 counties, Cook also elects its assessor.

Attorneys specializing in property tax appeals are among the top contributors to candidates running for assessor or the board of review.

An Illinois News Network analysis of campaign donations found that the bulk of top contributors to the campaigns of sitting Board of Review commissioners came from either attorneys or property developers with cases before the board.

And those attorneys benefit when the assessor makes an assessment that is too high and when the board of review agrees to lower it.

Some receive a percentage of the savings while others receive an hourly rate, but it is a system that benefits any attorney who can persuade an elected official to lower an assessment.

This contributes to Cook County having an extremely political assessment system, said Simpson.

During the time Madigan has been in power, no serious proposals to reform the property tax appeal system has gained traction in Springfield.

The last time Madigan was out of power was 20 years ago, when Republicans controlled the House, Senate and the Governor’s Mansion for two years.

“One of our top priorities was reforming the Cook County property tax system, which many people view as personally enriching politically connected Democrats,” said a senior GOP lawmaker who served in the House at the time but who asked not to be identified. “Quite frankly, what surprised us is not the resistance we got from Madigan but the resistance we got from politically influential Chicago businesses. They don’t want to see the system changed.”

Because of the pressure from businesses the reform measures ultimately fizzled, he said.

According to data obtained by Illinois News Network from the Cook County Treasurer’s Office, in one year period ending April 21, 2014, Madigan’s law firm, Madigan & Getzendanner, harvested $9.99 million in tax refunds for its clients mostly through lawsuits. In 2013, it also managed to get the Board of Review to reduce property valuations by $18.2 million on 1,467 properties.

The law firm has two partners and four associates.

Typically, Cook County law firms specializing in these types of cases collect 50 percent commissions on

the amount saved during the first year, said John Locallo, a Chicago lawyer specializing in property tax appeals and a past president of the Illinois State Bar Association.

Madigan spokesman Steve Brown said Madigan’s firm does not collect a percentage of refunds but charges clients by the hour or by a flat rate.

Earlier this year, Madigan told reporters that at times he personally earns more than $1 million in income annually. His salary as Speaker of the House is $95,000.

While the money he earns as a state official accounts for less than one-tenth of his overall income, Madigan has law firm that has benefitted from his political connections.

Besides the prestige of having the Speaker of the House’s name on the law firm letterhead, the firm gains in other ways.

“Mike Madigan is a pretty hard guy to say ‘no’ to when he asks for a favor,” said Elmwood Park Mayor Angelo “Skip” Saviano, who served in the General Assembly with Madigan and once counted the speaker as a close friend.

For example, Saviano noted that when a firm that manufactures meals for airline passengers opened in Berkley, Ill., more than a decade ago, Madigan approached the village’s then-longtime mayor Michael “Tony” Esposito and asked for an introduction to an executive with the company.

“When he called me, it was like, ‘Why on earth does Madigan want to talk to me?’” Esposito said. “Then I called Skip and then I called the attorney general’s office to make sure it was OK for me to call him back. When I called him, I found out Madigan wanted me to help his law firm.”

Ultimately, Esposito brokered a breakfast meeting, with Madigan, who he did not know, and the corporate executive who he did know.

“I don’t know if they cut a deal or not. But I do remember Madigan had oatmeal for breakfast,” Esposito said with a laugh.

Saviano noted this is an example of Madigan using his political clout to gain an advantage for his law firm.

“It might be hard for an elected official to say ‘no’ to Mike Madigan. Ya think?” Saviano said.

Of course there is nothing illegal about a politician benefitting financially from his elevated name recognition. Many lawmakers have law firms, insurance practices or other businesses that have benefitted similarly.

In fact, Joe Berrios operates an insurance practice, a lobbying practice, heads the Cook County Democratic Party and is also the Cook County assessor.

[pullquote]

Just who is Joe Berrios?

He’s the head of the Cook County Democratic Party.

He’s a Springfield lobbyist, a friend and political ally of House Speaker Mike Madigan.

He’s a proud family patriarch with a history of putting family members on the county payroll.

And he’s the person who has the most say on whether your property tax bills will go up or down. Read more…

[/pullquote]

“It’s rather interesting situation, you have Berrios going to Springfield to lobby Madigan and you have Madigan’s law firm going to the Board of Review and sometimes to Berrios’ office to contest assessments,” said Simpson, the political science professor at the University of Illinois at Chicago.

This cozy relationship has become well known among many in Cook County legal and business circles.

“If you are commercial property owner in downtown Chicago, you know what firms to go to if you want your assessment to drop,” Simpson said. “After all, it’s not rocket science.”

Simpson added that the current system is corrupt, inefficient and geared toward benefiting the politically connected at the expense of the ordinary taxpayer.

“When these politically connected commercial properties downtown get tax breaks they don’t deserve, it means that ordinary homeowners end up paying more in taxes to make up the difference,” he said. “That’s why we all should care about corruption in this system.”

Be First to Comment