Nov. 17, 2008

Story by Elizabeth Duffrin

Pilsen resident Omar Vega expects to save thousands of dollars in property taxes over the next 12 years in exchange for renovating his historic four flat on West 17th Street.

Thalia Hall’s pointed turret and Bohemian-style stone carvings set a fashionable trend in Pilsen after it was completed in 1893. Today, it serves as a community center.

Vega is among the first in his neighborhood to qualify for a property tax freeze since Pilsen was added to the National Register of Historic Places in 2006. Property owners within the Pilsen Historic District — which stretches between Halsted Street and Western Avenue, from 16th Street to Cermak Avenue — can earn tax benefits for renovations that preserve their buildings’ historic value.

So far, more than 40 residents have begun the application process. That process can prove somewhat daunting, however. To ease the way, the 18th St. Development Corp. set up a service to lead owners through the paperwork and site visits required by the state historic preservation agency. “Without that service, I would have hit a lot of roadblocks,” said Vega.

Called the Historic Preservation Initiative, the service may be unique in the state, according to Michael Ward, local government services coordinator with the Illinois Historic Preservation Agency. It’s the only initiative his office knows of that aims to preserve affordable housing through historic preservation.

And 18th St. Development Corp. may be the only neighborhood group in Illinois providing direct assistance with applications, he said. With 4,400 properties now eligible for tax breaks, Pilsen’s historic district is the state’s largest. Ald. Danny Solis (25th) spearheaded the campaign to designate the district with backing from the 18th St. Development Corp.

19th Century structures

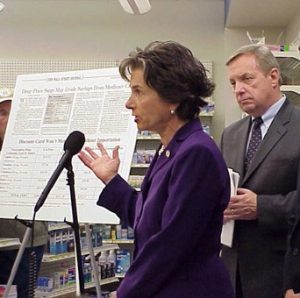

Omar Vega outside his four-flat in Pilsen

Many of Pilsen’s historic buildings date from the 1870s through the early 1900s, when Bohemian immigrants settled the area following the Great Chicago Fire. The neighborhood continued as a point of entry for immigrants, with Mexican families arriving in large numbers beginning in the 1950s.

In recent years, gentrification has lead to escalating property values and forced many long-time residents from their homes. “A lot of people say taxes are going through the roof,” said Kristy Menas, 18th St. Development Corp.’s historic preservation officer. “We’re using this [program] as a way to keep people in the neighborhood.”

The tax benefit will help Vega, a first-time homeowner at age 28, afford his investment in the century-old building. His parents, both Mexican immigrants, also manage property in Pilsen.

Advice for owners

To earn the tax break, Pilsen property owners can first verify with Menas that their property is on the list of registered historic structures. Staff from her office can visit the property to advise owners on the type of renovations that will likely win approval.

The Pilsen Historic District was once home to Bohemian immigrants who built brick homes like these following the Great Chicago Fire of 1871

Owners are also encouraged to submit an initial application to the Illinois Historic Preservation Agency for feedback before completing the final application. (Renovations completed up to two years prior to an application can still win approval if they meet federal guidelines and are adequately documented.)

Ward said his office is generally most concerned with protecting a historic building’s exterior, particularly the façade, and with the more public areas inside a home such as the entryway and living room.

“You want to maintain and preserve as much of the historic fabric as you can while still making it livable,” he said. Bathrooms and kitchens are of less concern. “It’s rare to find a bathroom or kitchen that hasn’t been updated since the 19th century,” he noted.

The benefit Vega earned is available only for owner-occupied properties with six units or fewer and requires rehab work of at least 25 percent of the county’s estimated market rate value for the building, an amount substantially lower than its actual market rate.

Vega spent $80,000 — double his minimum requirement — to replace the ancient wiring and plumbing and turn a dirt-floored basement into an updated apartment. His benefit will freeze the assessed value of his property at $21,700 for eight years, and then gradually readjust it to market rate over the next four.

Owner occupied

Two other types of tax benefits exist for renovating landmark buildings: a federal income tax benefit for large buildings and a property tax benefit for commercial building owners. However, all but a few of the applicants so far have been small, owner-occupied buildings, which make up the majority of the historic district, said Menas.

St. Adalbert Roman Catholic Church, built in 1912, is the Pilsen Historic District’s most notable Renaissance Revival structure

Jesse Orozco, another Pilsen resident with a pending application, plans to pass the tax benefit on to the future owners of the affordably priced condos he is creating from a dilapidated six-unit apartment building on South Loomis. Orozco, a city worker who undertook the project with his brother and sister in-law, said he couldn’t have made it through the application process without help from 18th St. Development Corp.

“I’m not a professional developer, and I would not have known where to turn to or how to get the information,” he said.

His project has not unfolded without setbacks, however. The preservation agency nixed his idea for wrought iron Juliet balconies and for exposed brick on the interior walls.

Still, he’s pleased with the final design, which includes new kitchens and bathrooms and, with the removal of an unused attic, raised ceilings and skylights on the top floor. Orozco, who grew up in Little Village and now makes his home in Pilsen, doesn’t expect his renovation project to be much of a money-maker. Rather, the goal is “personal satisfaction,” he explained.

“It’s nice to feel like you’re trying to better a community that you feel really strongly about,” he said. “It’s nice to take something that’s old and neglected [and] bring it back to life and make it shine.”

Categories:

At Home Business Civic Associations & Community Groups Editor’s Choice History & Preservation Money Matters Planning & Development Public Southwest Side

Tags:

18th st. development corp illinois historic preservation agency pilsen

Be First to Comment